Bitcoin: Regular Investing vs 'Smart Money' Buying

How to acquire the most Bitcoin on a limited budget

Reading time: 12 mins

For a long time now I've been fascinated with the idea that I can outsmart the markets. The key to investing is buy low, sell high right? Sounds easy, and actually it is as I'll show you through this article, but is it the best way to 'stack Sats'? (Sats, or Satoshis, are the equivalent of 0.000000001 Bitcoin)

I wanted to run an analysis of what I'm describing as 'Smart Money' buying (buy the dips, sell the highs), vs regular investments i.e. taking a small proportion of your salary each month and investing it regardless of the price (this is known as Dollar Cost Averaging (or Euro or Pound depending on where you live)).

I will point out that I'm not a trader, and I never will be. I just don't have the attention span, knowledge or inclination to sit in front of a computer all day watching chart patterns form. I will acknowledge that the best traders can seemingly see the Matrix and make more Bitcoin this way, but this article is for the rest of us. Those that are more likely to lose Bitcoin by trading in this way.

First let's set the scene.

What is Dollar Cost Averaging?

Let's say you have a lump sum of $1000 to invest and you want to put it in Bitcoin, what are your options? Well, you could put it all straight in. The short term effectiveness of this strategy is ultimately timing and largely luck. Bitcoin is subject to wild price swings, oftentimes thats good and it goes up, but it just as frequently goes in the opposite direction too. On any given day you could find that your $1000 becomes either $1500 or $500 depending on which way the price has moved.

An alternative, lower risk method, is to break down your $1000 into, say, 10 lots of $100, and invest over a period of time, perhaps weekly or monthly. This is called Dollar Cost Averaging because the dollar-cost of your Bitcoin gets averaged out over a number of purchases rather than in a single payment. This reduces risk in the short-term because you're not trying to time the market, and if the price of Bitcoin goes down you can buy more for your money (although the opposite is also true).

In this analysis, I chose to look at possible scenarios where I had a set amount each month to invest. Let's say my salary comes in monthly, and after all my expenses I have $100 left to put into Bitcoin.

With the goal of owning as much Bitcoin as I could, would I be best simply buying $100 every month regardless of price, or could I save the $100 each month and delay buying Bitcoin until there is a 'dip' in the price?

Let's first determine, what a 'dip' is, and how 'Smart Money' invests.

Introducing the Mayer Multiple

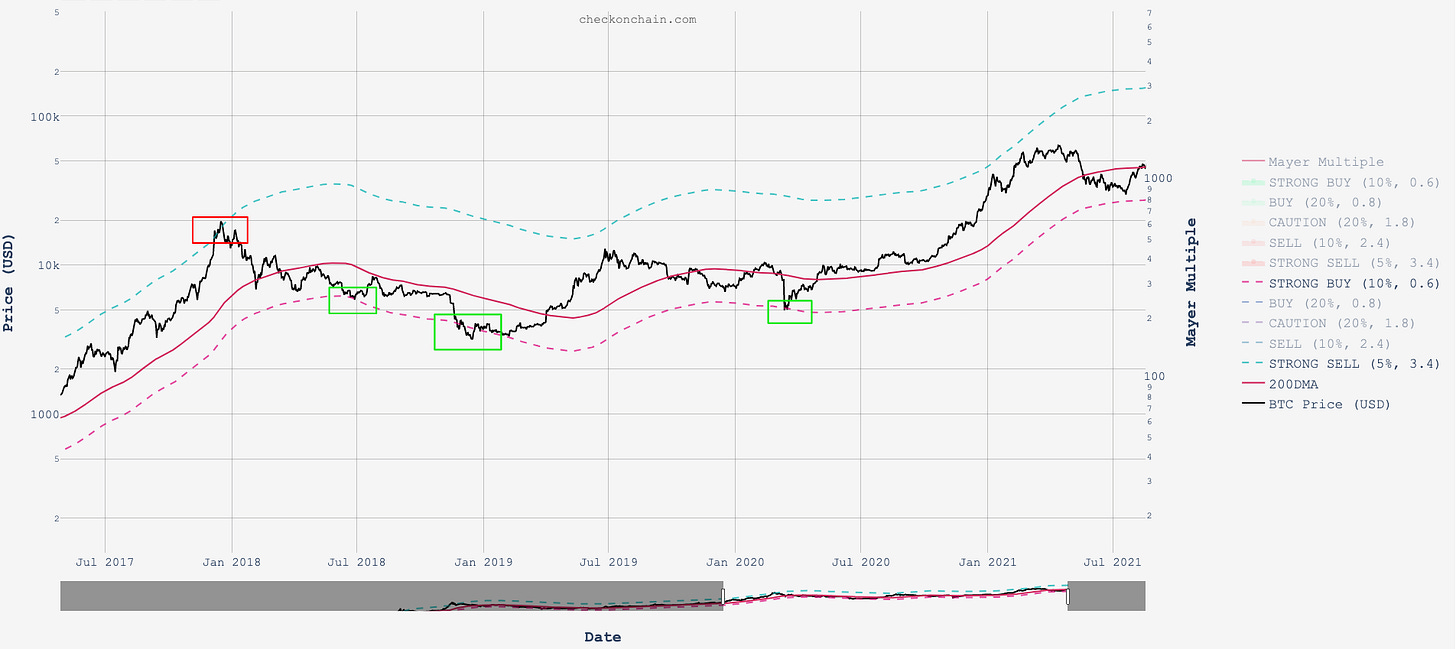

The Mayer Multiple is a simple, yet elegant, way to gauge the current price of Bitcoin against its historical price movements (in this instance using the 200 day moving average, which is simply the average price of Bitcoin over the previous 200 days). It highlights when the price of Bitcoin is either overbought or oversold.

In the chart above, I'm using 'resistance bands' as defined by @_Checkmatey to overlay the probabilities of a price move higher or lower. It's based on historical prices and how many days (out of Bitcoin's entire history) it has spent within those bands. For example, the 'Strong Buy' line is defined as such because the Bitcoin price has only ever been that low for 10% of its history and so probability suggests the price will move higher. On the flip side, when the price rises to above the 'Strong Sell' line, it has only ever been that high for 5% of its history, so there is an even stronger probability that the price will go down.

The green squares are what we will describe as 'Generational Buy' opportunities as they typically only come around once or twice per cycle (every 4 years) after a crash in Bitcoin price. You'll notice there was a bonus 'Generational Buy' opportunity in March 2020 as a result of the Covid pandemic crash, we'll come back to this. The red square is what we'll call a 'Blow-Off ' top and is a very strong sell signal in this context. Throughout its history, Bitcoin has typically gone through 4 year boom and bust cycles, where euphoric price rises end in near catastrophic collapses before regrouping and repeating to new highs.

Knowing that no-one can predict the exact top or bottom of the market we'll use 4 key price bands to test our 'Smart Money' ideas:

'Generational Buy' - 10% chance of price going lower

'Buy the Dip' - 20% chance of price going lower

'Sell local top' - 10% chance of price going higher

'Sell Blow Off Top' - 5% chance of going higher

Armed with a way to consistently measure buy and sell signals, can we use this knowledge to time the market and acquire more Sats as a result?

Buy and Hold (HODL!)

Firstly, let's assume that we never sell our Bitcoin, we only buy. I just want to accumulate as many Sats as I can over a period of time.

If I have $100 to invest each month should I just dollar cost average and buy each month or can I use the the 'Smart Money' ideas we just learnt about to time the market?

Here we are testing:

Investing $100 at the end of the month, regardless of price

Saving $100 every month and waiting until the next 'Generational Buy' opportunity presents itself before investing

Saving $100 every month and waiting until the next 'Buy the Dip' opportunity before investing

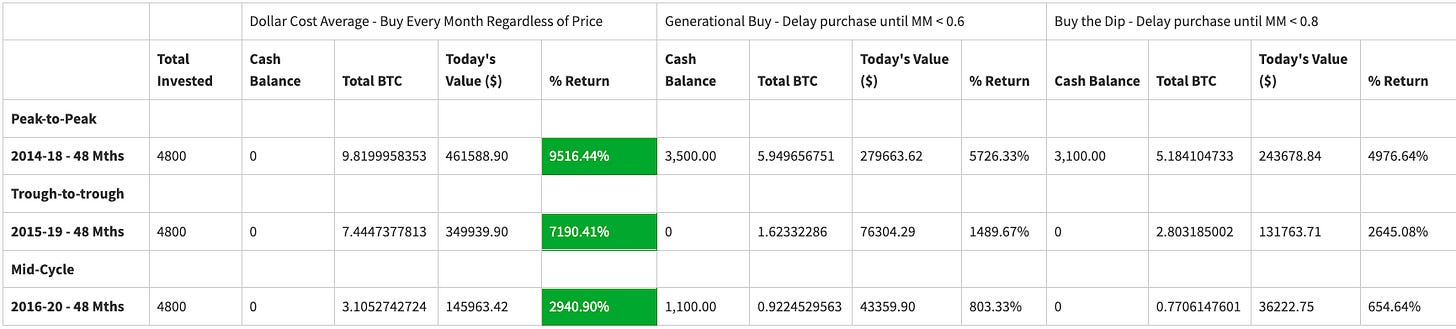

I built out the above calculator to test out the different theories described throughout this article. Historical price data was downloaded from https://au.investing.com/crypto/bitcoin/historical-data up to 26 August 2021.

When you look at how could I have maximised my Bitcoin holdings over the previous x number of months one thing was very clear:

Over virtually every time period regular investing is king. If you want to hold the most Sats, dollar cost average is your best friend, by far!

A couple of observations:

'Generational Buy' opportunities come around very infrequently, in fact there have been none over the last 12 months. If that is what you are waiting for you'd still be sitting entirely in cash! If we actually look at the previous cycle (2014-2018) you could have gone for 3 years without an opportunity arriving!

'Buy the dip' strategy is the least effective, it does beat Dollar Cost Averaging over the last 4 year period, but only just.

Over longer time frames, 5 & 7 years, the difference in returns is staggering. By regularly investing every month, like clockwork, you'd have over 2 times the number of Bitcoin by not trying to time the market.

There is an anomaly though.

I'm really intrigued by the fact that 'Smart' buying beat regular investing over a 4 year period. As we mentioned earlier, 4 years is the typical length of a Bitcoin cycle.

Are there clues here that will allow us to beat the market? Or allow us to trade differently based on where we are within the cycle?

Let's take a look at the previous cycle to see.

Timing the Cycle

As we mentioned earlier, Bitcoin has historically followed a 4 year boom and bust cycle and so it's really interesting to see that, so far, the only 'smart money' strategy to be more effective than regular investing is over a 4 year period. In this section, let's see if there is a way to change how we invest over the cycle to maximise the amount of Bitcoin we can accumulate.

We'll use the 3 strategies from above to evaluate the 2014-18 cycle covering 3 periods:

Peak to Peak - 2014-18

Trough to Trough - 2015-19

Mid-cycle to Mid-cycle - 2016-20

Once again, over every time period regular investing wins, by a SIGNIFICANT margin.

The challenge with timing is that once the cycle enters its 'bull' phase as marked on the chart below it never dips back below either 'buy line' again until after the cycle finishes, so the time out of the market sitting in cash is what kills the returns when you try to time it.

When we think back to our first chart from earlier, why then did the 4 year 'Smart Money' approach outperform the regular investment strategy when all other time frames favoured regular investing?

COVID-19. During previous cycles 'Smart Money' was only presented with one 'Generational Buy' opportunity per cycle. This current cycle was already unique because it provided two during the bear market in mid-late 2018, but normally that's it, you have to wait until the next cycle for another opportunity.

The Covid-19 Pandemic caused a sharp sell-off in all markets, an event referred to as a 'black swan', which is impossible to predict.

This provided 'smart money' with an unexpected mid-cycle buying opportunity, which raised returns over that 4 year period. If we were to ignore that event, regular investors take a clean sweep in superior returns across all buy and hold time periods, as below.

Whilst we can't ignore the fact that Covid happened, as a primary strategy, relying on a black swan event is far from ideal.

It does highlight the impact of timing though. If you have additional savings, or you want to invest a lump sum and the timing happens to be right, you can make outsized gains by investing when the 'generational buys' present themselves.

Buy low, Sell high!

Ok, so I get now that the best way to accumulate Bitcoin is to regularly invest, perhaps supplemented with a lump sum if a 'Generational Buy' opportunity occurs.

What about the sell signals though? If I sell at the top, then hold to buy back in at the bottom, could I increase the amount of Bitcoin I hold over time?

There are 3 scenarios here being compared to our core 'buy regularly and hold' base strategy.

First is to sell the 'Blow-Off' tops and wait for the 'Generational Buy' opportunities to buy back in.

Second is to use the more frequently occurring 'Local Highs' to sell and buy back in at the 'Buy the Dip' levels.

The third is a combination of the 2, 'Buy the Dip' but wait until the 'Blow-Off' top to sell.

It's worth noting initially that there are certain time frames that don't make sense to evaluate here with every strategy, which is why you see gaps in the table.

Observations:

Strategy 2 appears to be the most successful over the short term allowing you to more quickly stack Sats. As we've already discovered though this is due to the Covid-19 black swan event, and over time this strategy falls away in performance significantly.

Strategy 3 is a relative dud and doesn't outperform the other strategies over any time period

Strategy 1 is the best performer over 7 years, but significantly underperformed regular investing over 5 years. I suspect this is due to the amount of time spent out of the market, waiting for the next buy opportunity.

Regular investing, whilst not top performer across all time frames only narrowly misses out when comparing the amount of Bitcoin accrued

The major omission here is that I haven't taken tax into consideration. In most countries, selling your Bitcoin is a taxable event to Capital Gains Tax. I don't claim to be a tax advisor, so you should do your own research into how this may affect you, and if in doubt speak to a professional. If you do live in a high-tax environment though you will need to evaluate whether this strategy works at all.

Conclusion

The best way to accumulate Bitcoin over the long term is to set aside whatever you can afford each month, buy regularly and hold. Let time do the rest.'Smart Money' signals will present additional opportunities for you if you have surplus savings and can accelerate growth, but should not be relied upon as a primary investment strategy.

Whilst it may be appealing to wait for dips and feel like you're getting a discount, history has shown that the dips don't come frequently enough and the opportunity cost of being left out of the market is far more damaging over the long term than buying at a price that may be a short term high. Likewise, taking profits at the highs or trying to time tops is a similarly fruitless exercise and can often leave you holding less Bitcoin than you would've by just holding and waiting.

There is a cautionary tale in the data for strategy 2 (Buy the Dip, Sell Local Highs) detailed above. There are 3 seperate periods within the 7 year trading timeframe where that investor held more Bitcoin than they ended up with. They traded down over time by trying to be smart with their buying and selling activity. The impact of taxation further negates the effectiveness of this strategy. For me in Australia, the amount of tax payable on sale means that regular investing and not selling is the only strategy that makes sense. You will need to evaluate if this is the same for you, but I strongly suggest that it will be for the majority.

Turns out the 'Smart Money' techniques are pretty dumb as a primary strategy. A strategy that I have fallen for myself many times, by the way.

The best strategy is the simplest and the most accessible, so stack Sats and HODL.

TLDR; The best way to accumulate Bitcoin over the long term is to set aside whatever you can afford each month, buy regularly and hold. Let time do the rest. 'Smart Money' signals will present additional opportunities for you if you have surplus savings and can accelerate growth, but should not be relied upon as a primary investment strategy.

This should be considered for information purposes only and not as a recommendation to invest. Do your own research, understand the risks and make decisions that are right for you.